An organization that 15 years ago helped to open the first federally insured bank on the Pine Ridge Indian Reservation now offers several programs that teach young people how to manage money.

Lack of financial institutions and financial literacy are among many factors that have had long-term effects that can lead to higher rates of debt, lower credit scores and low financial mobility for reservation residents.

"The whole thing is pushing those goals to where we don't have to rely on the government, where we can get out there and be the working class," said Tawney Brunsch, executive director of Lakota Funds, a Native Community Development Institution based in Kyle.

It recently began its second year of the Tokeya Financial Education Program teaching financial literacy to young people on the Pine Ridge reservation. The program, which is entirely self-funded by Lakota Funds, hopes to teach self-reliance.

Reaching youth a key factor in mass financial literacy

The Family and Child Education program (FACE), which was instituted in 1990 by the Bureau of Indian Education, allows parents on rural reservations to join their young children in their educational settings, which the BIE said enhances parent-child relationships and improves educational outcomes.

Two schools on Pine Ridge, the Little Wound School in Kyle and Pine Ridge School in Pine Ridge, have active FACE programs.

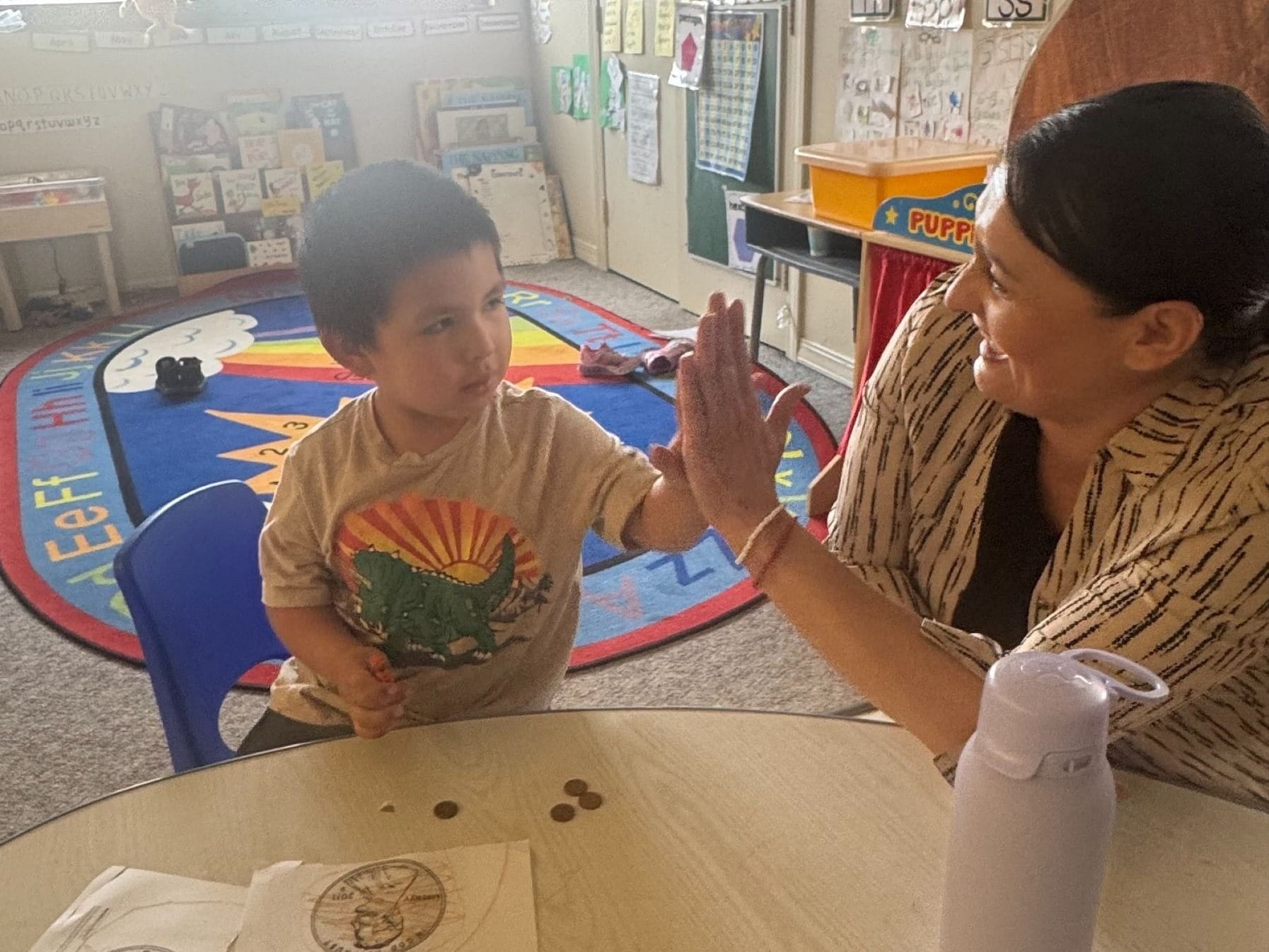

Last year, Lakota Funds began the Tokeya Financial Education Program in partnership with the Federal Reserve Bank of St. Louis. That program collaborates with the FACE curriculum at the Little Wound School to provide financial literacy programs to both parents and children.

"The whole thing is pushing those goals to where we don't have to rely on the government, where we can get out there and be the working class." – Tawney Brunsch, executive director of Lakota Funds

Lakota Funds also started the Tokátakiya matched savings program at the Little Wound School last year. Through the program, families participating in FACE will have the opportunity to, in addition to taking financial literacy classes, work on establishing their own savings accounts with assistance from Lakota Funds.

Tokátatiya means “towards the future” in Lakota, said Nicole Pourier, who leads the financial education program.

“When I look at our littles (the children participating in the matched savings program), we're planting the seed. And once we plant the seed, we get to watch it grow. And so what Tokátakiya means is we get to watch them grow and bloom through the future, and we're going to be a part of their lives for the next couple of years," she said.

FACE allows parents not just to help their children learn but to learn alongside them as well, Pourier said. For many parents – some of whom are working toward their GED certificate or other education milestones – it's also the first time they are being exposed to certain financial concepts.

“It's so fun to be doing two different lesson plans where they mean the same thing at different age levels that they can take home together. They're learning the banking world, money, all the financial stuff. And it's so exciting,” Pourier said.

At the end of the program, families that participated in the Tokátakiya program will be able to start a certificate of deposit with the Lakota Federal Credit Union, the reservation's first federally insured financial institution, which Lakota Funds helped open in 2013.

High school seniors at Crazy Horse School in Kyle are also getting monthly personal finance lessons and saving for their class trip in the spring through the Tokeya program.

“It's so fun to be doing two different lesson plans where they mean the same thing at different age levels that they can take home together. They're learning the banking world, money, all the financial stuff. And it's so exciting." – Nicole Pourier, education programming leader

Pourier checks in with their progress each month and helps them plan out what needs to be saved to reach their own goals. This month, seniors will learn about paychecks and W-2s as well as other employment-related finance principles.

"I figured if I could reach 10 kids at one high school, that's a win, you know? And then next year we can build on and figure out a way to make it work in the future," Pourier said.

While there are challenges that come with teaching the next generation, connecting with them through her own life experience growing up on Pine Ridge often proves successful, she said.

"Your success is already impacting the next generation. That's what we want for our families who are participating in this. It's not just about the dollar amount in the matched savings. It's about sharing that story because maybe no one else is sharing that kind of story," Pourier said.

Brunsch told News Watch that creating an environment where financial education is part of everyday life is critical to earning tribal sovereignty, a goal that’s reflected in the group’s vision/mission statement: “sovereignty through self-reliance.”

Lakota Funds sees similar challenges, but renewed opportunity, 40 years later

Lakota Funds, which was the first Native Community Development Institution in the country and sponsored the LFCU upon its opening, began providing business loans and assisting in job creation and business establishment in 1987.

Its work focuses on eliminating barriers to economic development on the reservation, which include access to capital, business networks, infrastructure and technical assistance.

On the Pine Ridge reservation, about 48% of residents live below the poverty line, according to the U.S. Census Bureau. Brunsch, who has served as executive director of Lakota Funds since 2008, told News Watch that while the organization has evolved since its creation, many of its goals remain the same.

"I feel like a lot of the needs are still the same, that there hasn't been a lot of change in some areas. There's still that need for financial awareness for this idea of self-reliance, there's still a lot of families out there that are dependent and have been for many generations, on support," Brunsch said.

"We have definitely more resources and a whole new subset, if you will, of youth, that do understand what the possibilities are and that are taking steps to to move forward with their secondary education or trade school or a trade or a job now."

Lakota Funds' work, in addition to loan and financial programs, also extends into community development through education and workforce access initiatives like its construction internship program, which has paired over 100 interns with local builders.

Future goals reflect current commitment to self-sufficiency

While the financial education programs are, for now, limited to Crazy Horse and Little Wound Schools, executives at the Lakota Fund said they hope to see similar programs expand to the rest of the reservation and to other tribal communities in the state.

Because the program is self-funded, there are certain limits to growth. But that also allowed for a level of freedom that grant-based programs do not always have, Brunsch said.

“The fact that this was self-funded is part of the reason that we were able to move forward with it because Lakota Funds' lending is doing well. We've been pursuing self-sufficiency and sustainability without any federal support for years," Brunsch told News Watch.

"...I hope that this is just one little building block to get to where we have the sovereignty for self-reliance, that we have the ability to allow these kids to stay home and grow and build and shape our future, our communities." – Ellen White Thunder, deputy director of Lakota Funds

"We're hoping that through this program, we are starting to establish a bit more self-reliance and establish a bit more sovereignty in our families, in our communities, through asset development and through wealth building."

Ellen White Thunder, deputy director of Lakota Funds, said the future for the program is broad and could involve adding new forms of education into their outreach programs. And, hopefully, the effects will cascade down to permanent improvements in quality of life on the reservation, she said.

"I would love to see more STEM somehow incorporated into this and really tied together with the framework that's already there. I would love to see our children have the knowledge and understanding of the opportunities that are in the different career fields, career paths," White Thunder said.

"Beyond that, I would hope that in 15, 20 years that we have our own high-level jobs (on the reservation). And I'm not saying that we don't have high-level jobs but a variety of high-level jobs here. And I hope that this is just one little building block to get to where we have the sovereignty for self-reliance, that we have the ability to allow these kids to stay home and grow and build and shape our future, our communities."

Pourier, who has lived on the Pine Ridge reservation her entire life, said that programs like Tokeya allow her to remind students that they are capable of doing great things.

"The stuff that I tell my parents and my students is that we're gonna face this, we're gonna face challenges. We're gonna climb mountains. We got to. But it's hard. I'm not saying it's easy, it's hard, but we can get there if we're determined," Pourier said.

This story was produced by South Dakota News Watch, an independent, nonprofit organization. Read more stories and donate at sdnewswatch.org and sign up for an email for statewide stories. Investigative reporter Molly Wetsch is a Report for America corps member covering rural and Indigenous issues. Contact her at molly.wetsch@sdnewswatch.org.