Editors note: This is the first in a series of stories on a South Dakota News Watch and Chiesman Center for Democracy poll that surveyed 500 South Dakotans on a variety of political topics. Stories will be published weekly through mid-January.

A year after Gov. Kristi Noem vowed to eliminate the state sales tax on groceries, and several months after lawmakers failed to deliver on her promise, a strong majority of South Dakota voters still supports dropping the sales tax on food.

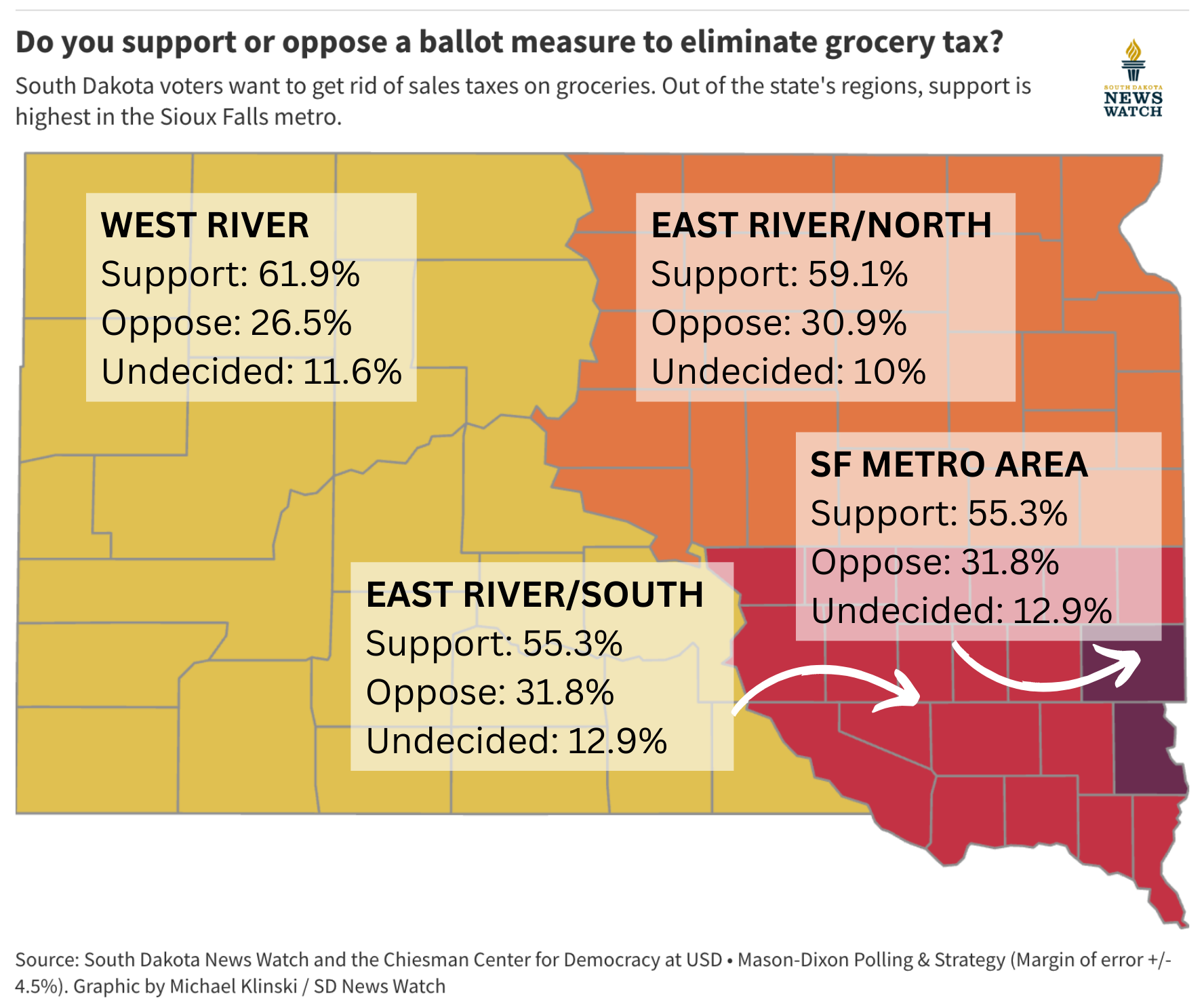

A new statewide poll co-sponsored by South Dakota News Watch showed that 60.6% of registered voters support a proposed statewide ballot measure that would eliminate the 4.2% state sales tax on groceries.

While 28.8% of overall voters opposed the cut and 9.6% were undecided, the poll showed majority support for eliminating the tax among Democrats, Republicans and Independent/No Party Affiliation voters across the state.

Some lawmakers and consumer advocates have been fighting without success to eliminate or reduce the grocery tax for decades, calling it a harmful tax on a staple need for individuals and families and a regressive tax that disproportionately affects low-income people who pay the same rate as wealthy residents.

South Dakota is one of 13 states that levies a sales tax on groceries. And it's one of two states that tax food at the full state sales tax rate without any offsetting tax credits. People who qualify for the Supplemental Nutrition Assistance Program, or food stamps, are exempt from the sales tax on food.

The state Department of Revenue didn't respond to a News Watch request to questions about the impact of cutting the grocery tax. But previous estimates put the cost of the tax on consumers – and the accompanying loss in state revenues – at about $100 million a year.

As previously reported by News Watch, the tax on groceries exists among a state taxation system that is rife with sales tax exemptions totaling more than $1 billion a year that overwhelmingly benefit the state’s largest industries such as agriculture, medical care, insurance and advertising.

Recent and ongoing efforts to eliminate the state sales tax on food would not affect the up to 2% sales tax on groceries charged by municipalities in South Dakota.

Lawmaker: Grocery tax 'causes hunger'

State Sen. Reynold Nesiba, D-Sioux Falls, opposes the grocery tax and is not surprised that most respondents in the statewide poll support eliminating it.

“It causes hunger,” he said. “We have a federal food system, we have all sorts of charities that try to address this and it seems wrong at the same time to be charging 4.2% by the state and 2% by the cities just to buy food.”

Nesiba, who has failed in previous attempts to eliminate the grocery tax through the legislative process, said he has drafted a bill to do so again in 2024 but is not sure if he will submit it.

“It’s a regressive tax because lower-income people pay a bigger share of their total paycheck on food. And beyond that, nobody should have to pay a tax to be able to eat,” Nesiba said. “It’s a very broad tax that even applies to infant formula and baby food. And frankly most states are able to get by without this tax.”

Poll conducted in late November

South Dakota News Watch and the Chiesman Center for Democracy teamed up to enlist Mason-Dixon Polling & Strategy to conduct a cellphone and landline poll of 500 random registered South Dakota voters Nov. 27-29, 2023. Respondents were representative of all South Dakota counties, ages, gender and political parties. The margin of error is plus or minus 4.5%.

For the past several years, South Dakota was one of three states, along with Alabama and Mississippi, that taxed groceries at the full state sales tax rate with no exemptions allowed.

But starting Sept. 1, 2023, a new law took effect in Alabama that dropped the sales tax on groceries from 4% to 3% in that state and which will reduce it again to 2% in 2024 if state revenues allow. City and county governments in Alabama, as in South Dakota, can add their own local sales tax on groceries. But the new law allows those entities to also cut their food tax by 25% a year when revenues allow.

The calls to eliminate the grocery tax took on new momentum in late 2022 when Noem, facing reelection at the time, made high-visibility public announcements that she wanted to drop the tax. In a written position statement at the time, Noem said her “number one priority for the 2023 legislative session” was eliminating the grocery tax.

But lawmakers did not abide and in a compromise move, approved a temporary 0.3% reduction in the overall state sales tax, from 4.5% to 4.2%, until 2027, while keeping the full grocery tax in place.

Gov. Kristi Noem still supports end to food tax

Noem continues to support elimination of the grocery tax but isn't convinced the Legislature will pass such a measure this year, according to Ian Fury, the governor's chief of communications.

Noem declined an interview request, but Fury did send News Watch a written statement in response to questions about the grocery sales tax.

“Governor Noem agrees with a majority of South Dakotans that a grocery tax cut is the best tax relief option for the people of South Dakota," Fury wrote in an email. "The legislature has not indicated that they are willing to pass such a tax cut. Should they change their mind, Governor Noem would love to work with them to deliver it for the people.”

South Dakota legislative action unlikely in 2024

One legislative leader told News Watch that he does not support elimination of the food tax and does not anticipate the measure would pass in the upcoming session if a bill is filed.

Rep. Will Mortenson, R-Pierre, said it is "irresponsible" to talk about cutting a significant funding source like the sales tax on groceries without making significant corresponding cuts to expenses, including for the state's main spending areas of education, health care and state employees.

“I bet a strong majority of South Dakotans would favor a property tax cut and a strong majority would favor a sales tax cut, but there’s not just one side of the coin,” said Mortenson, the majority leader in the House of Representatives. “Unless you support less pay for teachers, closing more nursing homes and support less public safety, I don’t think you can responsibly talk about cutting something like the food sales tax without a plan to cut spending also.”

Statewide grocery tax ballot measure progressing

Nesiba said he remains committed to eliminating the tax but does not support the initiated ballot measure proposed by Dakotans for Health because the language is too broad and could have unintended taxation consequences.

Rick Weiland, head of Dakotans For Health, said his organization submitted language to the Secretary of State's Office for a constitutional amendment and an initiated measure, both of which would accomplish the goal of eliminating the grocery tax in South Dakota, if voters approve.

Weiland said the group is now collecting voter signatures only for an initiated measure, which he said will almost surely have enough signatures to appear on the statewide ballot in November 2024. The petition needs 17,000 signatures to make the ballot and the group already has well over that total and is still collecting names, he said.

Dakotans For Health, which has successfully pushed other ballot measures such as the expansion of Medicaid in South Dakota, must put the issue before voters because the Legislature has failed to eliminate the grocery tax after numerous bills have failed, Weiland said.

“It’s been voted on over 20 times over the past 20 years, and there’s support for it, but they can’t seem to get it done in the Legislature,” he said. “When the Legislature is unwilling, the founding fathers have given the voters of South Dakota the opportunity to make an end run and take it directly to the people.”

Weiland said he is aware of criticisms that the group’s ballot proposal is too broad. But he rejects those arguments and suggests that voters will make up their minds whether they want groceries to be taxed or not. If an initiated measure passes, the Legislature would still have the ability to adjust the intent or outcomes through the lawmaking process if it saw fit, he said.

“We feel this is spot on,” Weiland said. “They can say it’s poorly written or too broad or whatever. But the fact of the matter is that we’re taxing groceries in South Dakota at 4.2% and we’re only one of two states now doing that.”

According to the News Watch/Chiesman poll, eliminating the grocery tax was supported by a majority of men (61.8%) and women (59.0%) and based on age was supported most strongly among those 18-34 (61.9%) and voters aged 65 or over (66.4%).

Longtime advocate still pushing for change

Cathy Brechtelsbauer of Sioux Falls, S.D., with the group Bread for the World, has fought to end the grocery tax in South Dakota for nearly 30 years. She said she is not surprised at the recent poll results because many families are struggling to afford good food for their families, and they were not helped by the small sales tax cut approved by the Legislature in 2023.

“The poll shows people are not satisfied with the tax cut the Legislature did last year, and it shows they still need the tax off their food,” Brechtelsbauer said. “People notice what happens to their bill in the grocery line, and they really feel the impact of that tax.”

Nesiba said dropping the state sales tax on groceries would save a family more than $4 on a $100 grocery bill, while the 0.3% sales tax decrease passed by the Legislature in 2023 would save that family 30 cents on that same bill.

Besides disproportionately affecting lower- and middle-income people, the grocery tax also hurts nursing homes that pay large food bills to keep their residents healthy, Brechtelsbauer said.

“Hospitals don’t pay it, but nursing homes do, and it’s a big expense for them,” she said. "I think the poll shows support for helping everybody pay their grocery bills."