Two-thirds of South Dakotans support an initiated measure that would prohibit the state from collecting sales tax on "anything sold for human consumption, except alcoholic beverages and prepared food,” according to a scientific poll co-sponsored by News Watch.

The statewide survey of 500 registered voters, also sponsored by the Chiesman Center for Democracy at the University of South Dakota, showed that 66% of respondents are for the 2024 ballot measure, with 26% opposed and 7% undecided.

That means public support for Initiated Measure 28, which would eliminate the state's 4.2% sales tax on groceries, has increased since a November 2023 poll that showed 61% of registered voters in favor of it.

Supporters call the measure a long-overdue effort to take the tax burden off low-income families and individuals. South Dakota is one of just two states, along with Mississippi, that fully taxes food without offering credits or rebates.

Opponents criticize the wording of the measure as broader than just groceries. They said it could cause a budget crunch by preventing the state from collecting sales tax on “consumable” items such as tobacco, toothpaste and toilet paper.

“This is not a food tax repeal – it’s a consumables tax repeal,” said Nathan Sanderson, executive director of the South Dakota Retailers Association, which publicly opposes the measure.

'Should have been done 20 years ago'

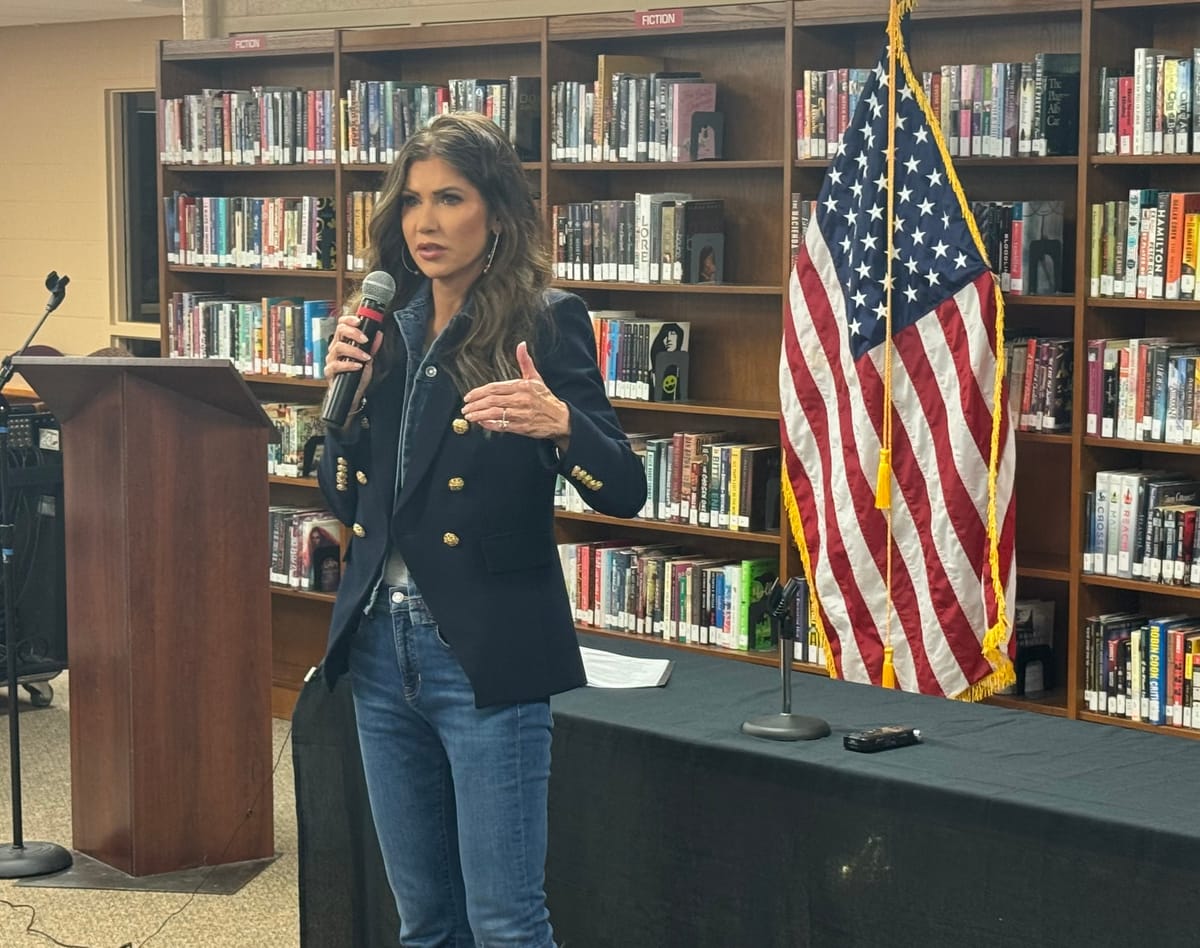

Rick Weiland of Dakotans for Health, the petition group that sponsored IM 28, noted that Gov. Kristi Noem pushed for repealing the grocery tax during her 2022 re-election effort. In announcing the campaign pledge, Noem said the tax cut would "put hundreds of dollars in the pockets of the average South Dakota family.”

“This affects people of modest means who are just trying to put food on the table,” Weiland told News Watch. “It should have been done 20 years ago, which is why you’re seeing a super-majority of South Dakota voters in support of it.”

Mason-Dixon Polling and Strategy conducted the poll May 10-13. Those interviewed were selected randomly from a telephone-matched state voter registration list that included both landline and cellphone numbers. Quotas were assigned to reflect voter registration by county. The margin of error is plus or minus 4.5 percentage points.

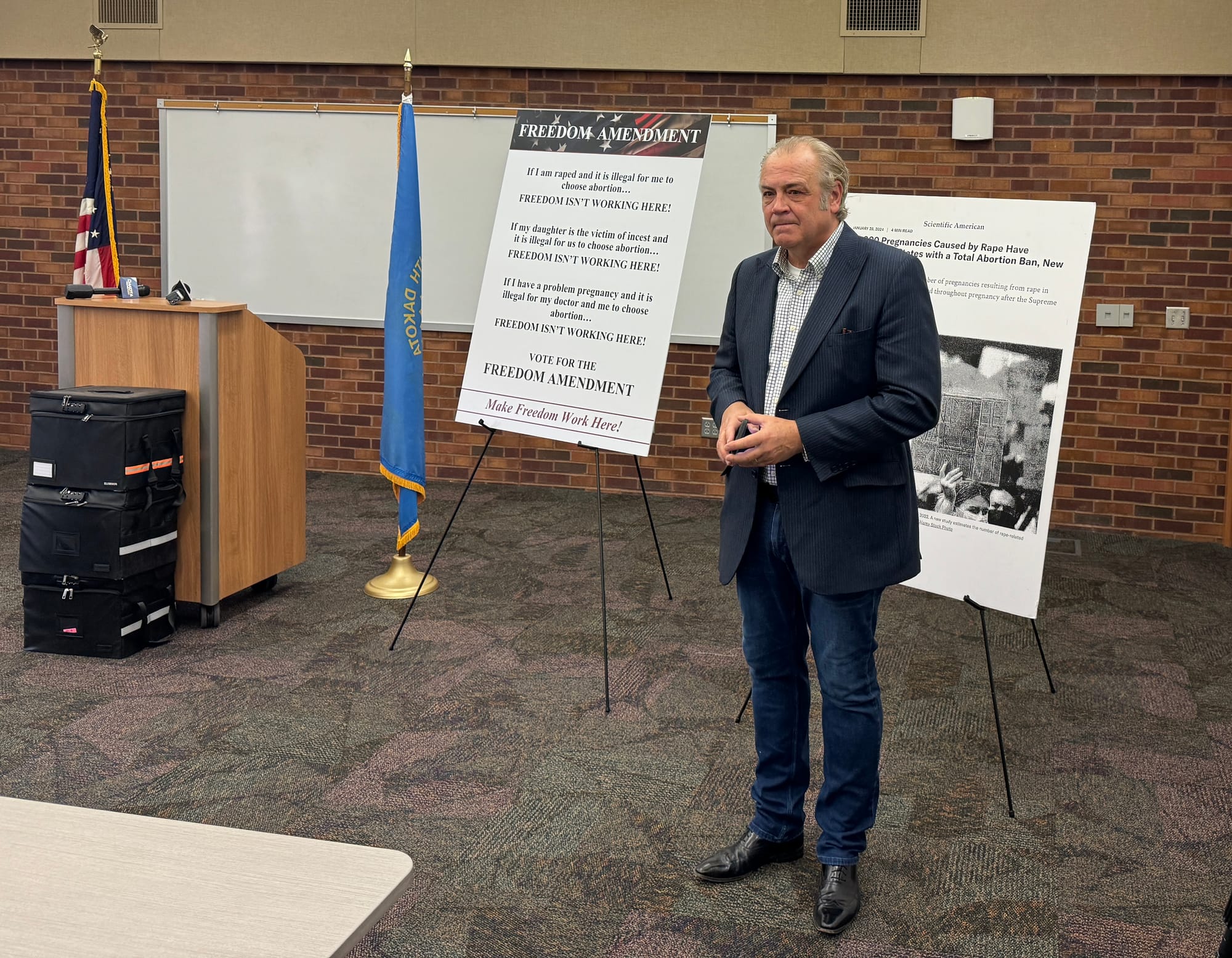

Nathan Sanderson, executive director of the South Dakota Retailers Association

Concerns about budgetary impact are more pronounced since state legislators voted to lower the general sales tax rate from 4.5% to 4.2% during the 2024 legislative session. It sunsets, or expires, in 2027.

Sanderson echoed concerns raised by Attorney General Marty Jackley in his ballot explanation that IM 28, by interrupting collection of sales tax for certain items, could “affect the state’s obligations under the tobacco master settlement agreement and the streamlined sales tax agreement.”

Opponent: Plan will trigger income tax

Not taxing “consumables” and losing those revenue streams could result in an annual state budget downturn of at least $176 million, according to Sanderson, on top of the $104 million estimated annual revenue loss from the general sales tax cut.

Sales taxes are the largest source of state government revenue in South Dakota, one of seven states without a state income tax.

“I believe this measure was drafted the way it was for one of two reasons,” said Sanderson, who served as a policy adviser to former Gov. Dennis Daugaard. “Either it was designed to force South Dakota to implement a state income tax to replace the lost revenue or it was drafted incorrectly. Either way, it’s highly problematic.”

Weiland pushed back strongly on those assertions, calling them "fear tactics and misinformation" and noting that the Legislative Research Council played a role in changing the measure's language.

As for the notion that Dakotans for Health is surreptitiously trying to trigger a state income tax, Weiland called the theory "ridiculous."

"Mr. Sanderson needs to do his homework before he makes such wild allegations about our secret intentions," said Weiland, a former South Dakota Democratic Party candidate for U.S. House and U.S. Senate. "With 94 Republican and 11 Democratic legislators in Pierre, (Republicans) can do anything they want. I don’t think passing a state income tax will ever be part of their legislative agenda."

Debate over municipal food tax rates

It’s been an eventful petition process for Dakotans for Health, which had to re-submit language for the measure in November 2022 after then-Attorney General Mark Vargo issued a ballot explanation saying the measure would impact the ability of municipalities, and not just the state, to collect sales tax on groceries.

That interpretation differed from that of then-Legislative Research Council director Reed Holwegner, who noted in a 2022 fiscal summary that “municipalities could continue to tax anything sold for eating or drinking.”

Most municipalities collect 2% on groceries on top of the state tax rate. Weiland’s group added specific language to the measure after Vargo's explanation to maintain that they could continue to do so.

But opponents cite a state law that states cities and towns can charge a sales tax if the tax "conforms in all respects to the state tax ... with the exception of the rate," which would not be the case if the state food tax is repealed.

“Cities and towns can only tax the same items as the state,” said Sanderson. “So despite the language in IM 28, if the state cannot charge a tax on ‘anything for human consumption,’ neither can a municipality.”

Jackley’s current ballot explanation notes that “judicial or legislative clarification of the measure will be necessary.” Since it’s an initiative measure and not a constitutional amendment, it’s reasonable to assume that state legislators will address it during the 2025 legislative session if it passes.

Language of measure under scrutiny

Beyond disagreements about municipalities, there were early discussions between Dakotans for Health and the LRC about how to best characterize which items were included in the repeal.

Hollweger, who resigned as LRC director during a meeting of the Legislature’s executive board in October 2023, addressed the potential for differing interpretations of “anything sold for human consumption” in an updated fiscal summary in January 2023.

“For purposes of this fiscal note,” he wrote, “the LRC assumes the phrase only includes food items because of the modifying language 'except alcoholic beverages and prepared food' and does not include personal tangible property and services, both of which can also be sold for human consumption. Other assumptions as to the meaning of this phrase may be just as reasonable, if not more so.”

With that qualification, the fiscal note said that the state could see a reduction in sales tax revenue of $123.9 million annually, much lower than Sanderson's estimate. It also reiterated that municipalities "could continue to tax anything sold for human consumption."

In his ballot explanation, Jackley asserted that human consumption "is not defined by state law, but its common definition includes more than just food and drinks.”

'Simply the right thing to do'

Weiland points out that IM 28's original draft, which used the phrase "anything sold for eating or drinking by humans," was flagged by the LRC as being too imprecise.

In a letter to Dakotans for Heath in December 2022, Holwegner said that the wording "may be overly vague, inviting various interpretations in determining its meaning."

Holwegner added that "the statutory definition of food uses the terms 'ingestion,' 'chewing' and 'consumed.' These terms seem to be more precise than 'eating or drinking,' as they may better capture the various elements of food and beverage consumption."

Following that guidance, Dakotans for Health re-submitted the language as "anything sold for human consumption" and collected signatures for both a constitutional amendment and initiated measure.

Weiland and his team ended up prioritizing the IM effort, and it was certified for the 2024 ballot on May 13 by the Secretary of State's office with 22,315 valid signatures.

In an interview with News Watch, Weiland expressed frustration that concerns about inexact wording and unintended consequences seem to persist regardless of the language put forth in the measure.

"We worked closely with various state offices on the grocery tax repeal measure as we do with all the ballot measures we get involved with," Weiland said. "Repealing this tax is simply the right thing to do."

Noem's grocery tax plan 'changed things'

South Dakota’s grocery tax has been a target of legislative reform for decades, mostly by Democrats.

In 2004, the South Dakota Democratic Party gathered enough signatures to put a state food tax repeal on the ballot after legislative attempts to eliminate the tax fell short.

Opponents of the effort, including then-Gov. Mike Rounds, warned that passing the repeal would likely reduce the amount of state aid available for schools and health care.

Voters responded to that message and rejected the measure by a margin of 68% to 32%. Later attempts by state legislators to lower the tax on food or exempt groceries from the general sales tax rate also failed.

Noem shifted the dynamic in September 2022, six weeks before being reelected with 62% of the vote and mindful of Weiland's plans for a petition drive.

At an event in Rapid City, she unveiled her plan to repeal the grocery tax for the “largest tax cut in South Dakota history.” She vouched for its affordability because of double-digit increases in sales tax revenue in 2021 and 2022, a budget surplus in 2022 of $115 million and $423 million in reserves.

“That changed things,” Weiland told News Watch.

“The Republicans’ big argument has always been, ‘Oh, we don’t have the money to repeal the food tax. It will come on the backs of firefighters and teachers, or we’ll have to do a state income tax’ – all this crap they kept contending so the issue never got any legs in the Legislature or on the ballot. Well, the governor took all those arguments and threw them in the trash. They don’t exist.”

Noem supports tax repeal, but not IM 28

But Jim Terwilliger, the governor’s budget chief, stressed that the basis of Initiated Measure 28 differs from the bill that Noem and her team brought unsuccessfully during the 2023 legislative session.

Noem’s bill, which was killed in committee, would have reduced the state’s sales tax on groceries to zero percent rather than eliminating it entirely. The reason was to avoid disrupting South Dakota's participation in the Streamlined Sales Tax Project, a cooperative effort of states, local governments and the business community that standardizes collection of sales tax.

“As drafted, the ballot measure would bring us out of compliance with the agreement,” Terwilliger told News Watch in May 2023.

Terwilliger also said that the measure would “prevent the state from taxing tobacco or medical marijuana,” a concern also noted by Jackley in his ballot explanation. Not taxing tobacco could impact revenue the state receives from a master settlement agreement reached in 1998 between 46 states and major cigarette manufacturers as part of litigation for health-care costs and deceptive trade practices.

Jackley said South Dakota receives about $20 million annually from the settlement, which Sanderson factored into his estimated annual loss of state revenue of $176 million.

Grocery tax repeal has bipartisan support

Weiland disputes those legal interpretations, which could end up being debated during the 2025 legislative session or resolved in a court of law.

He also notes that the South Dakota tax system is rife with sales tax exemptions totaling more than $1 billion a year that primarily benefit the state’s largest industries such as agriculture, medical care and insurance, as previously reported by News Watch.

“There’s a whole list of things that these companies are allowed exemptions for to maintain their business in South Dakota,” said Weiland. “But we’re not going to get rid of a regressive tax on food, something people need to survive? What does that say about our priorities?”

The News Watch/Chiesman poll showed that repealing the grocery tax has bipartisan appeal, with 78% of Independents, 74% of Democrats and 56% of Republicans saying that they support the initiated measure.

Young voters were the most supportive, with 73% of respondents ages 18-34 saying they are for the measure, compared to 21% against.

Other results from the poll

This story was produced by South Dakota News Watch, a nonpartisan, nonprofit news organization. Read more in-depth stories at sdnewswatch.org and sign up for an email every few days to get stories as soon as they're published. Contact Stu Whitney at stu.whitney@sdnewswatch.org.